Considering the implications of depreciation for HDB flats

By Chang Zhi Yang and Andrew Yeo

Public housing is an inextricable part of life in Singapore today. Its unique relevance extends beyond its housing imperative into the social, political and demographic spheres of Singapore society. Public flats in Singapore are more than just homes, as they have been tied to larger policy objectives such as building a sense of community and national pride, and encouraging marriage and the creation of families.

As of 2014, 82% of Singapore residents lived in Housing & Development Board (HDB) flats. Over nine in 10 of these HDB residents own their own flats after decades of sustained efforts by the government to promote home ownership. This is a source of national pride. Married couples have also traditionally been given perks and priority in obtaining newly-built HDB flats.

The HDB flat is an important asset of many Singapore residents. As much as 95.1% of public housing owners financed their flat purchases with their CPF funds, which is Singapore’s main mechanism of social security. But as a 99-year leasehold property, HDB flats will certainly reach zero value once the 99-year lease is up. Deputy Prime Minister Tharman Shanmugaratnam, in his Budget 2014 debate round-up speech last year, highlighted how two-thirds of our HDB flats will be 30 years or older by 2020. In a January 2014 exchange in Parliament, National Development Minister Khaw Boon Wan said, “Like all leasehold properties, HDB flats will revert to HDB, the landowner, upon expiry of their leases.”

Mr Khaw added that the Selective En Bloc Redevelopment Scheme (SERS) — where older estates are demolished, and compensation and new housing subsidies are offered to displaced residents to buy flats in a nearby area — was contingent on several factors. This included “their redevelopment potential, and the availability of replacement sites for rehousing and other resources.”

This essay highlights the depreciation attribute of leasehold HDB flats, before looking at some of the possible implications of this on different groups of Singapore homeowners.

Illustrating the depreciation of HDB flats

Determining the monetary effects of depreciation of HDB flats is difficult, especially for assets with a short history of existence like HDB flats because there is yet a market to help price the depreciation schedule.

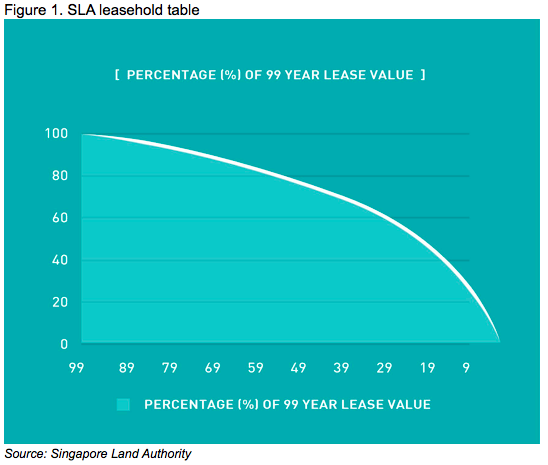

To illustrate depreciation, we generated a hypothesised depreciation schedule based on the Singapore Land Authority’s (SLA) leasehold table for calculating development charges for land leased out by the state. We did this since land and property are two closely related assets. We note though that the SLA leasehold table does not take into account factors affecting the pricing of HDB flats such as enhancements to the flat and neighbourhood, population expansion and the performance of the Singapore economy. Hence, it may not be reflective of observable market price movements today.

The graph below is based on the SLA leasehold table, with the values adjusted so that the 99-year leasehold land becomes the base year. As presented in the figure, as the lease of the land declines, its relative value drops too. What the curve represents is the depreciation schedule of a leasehold plot estimated by SLA. At the end of 99 years, because the land reverts back to SLA, it would not retain any value.

Assuming that the depreciation schedule of a HDB flat takes on the same curve as the one presented by the SLA leasehold table above, the theoretical depreciated value 30 years from now of a resale HDB flat with 80 years of lease remaining would be 82.1% of today’s valuation. If the flat has only 70 years of lease remaining, the theoretical depreciated value in 30 years’ time would be 79.6% of today’s valuation.

The key point to note is that while the value of the flat 30 years later will be lower than today’s value, the flat with fewer lease years remaining at the point of purchase experiences an accelerating decline in value as time passes when the remaining lease term drops below 50 years.

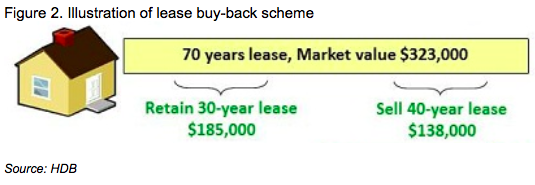

An example of tail-end lease monetisation under the lease buy-back scheme provided by the HDB is also instructive. The lease buy-back scheme is one option provided by the HDB to help older homeowners monetise their HDB flat.

In the HDB’s example, for a flat with 70 years left on its lease and a market value of $323,000, the present value of the 40-year tail-end lease is worth $138,000 or 42.7% of the flat’s market value. Using the theoretical future value derived from the SLA leasehold table, this implies a 2.1% discount rate. This discount rate seems reasonable when compared to HDB concessionary interest rate (2.6%) and CPF ordinary account floor interest rate (2.5%). However, by accepting this lease buy-back scheme, the homeowner is foregoing the possibility of reselling the flat during the retained 30 years of lease term.

In this sense, it is important to recognise that many different depreciation schedules can be used, but it is impossible to ascertain which one is the most appropriate since there are no existing markets to price ageing HDB flats yet (for example, there are no futures market to price the value of a HDB flat with only 10 years of lease left).

While the exact pathway of property price movement cannot be determined, it is irrefutable that HDB flats, being 99-year leasehold assets, will eventually depreciate in value as the lease reaches expiration. As such, there will come a point in time when the price of an ageing HDB flat reaches an inflection point as the erosive effects of HDB lease depreciation act as an ever-increasing drag on residents’ housing equity. This is especially critical when retirement nest eggs are particularly concentrated in this asset class. What are the implications for the vast population of HDB flats owners then when the country segues into this new public housing paradigm?

Implications

Given how embedded Singapore’s public housing is in the fabric of society, depreciating values of ageing HDB flats will likely have social, political and economic implications. The remaining discussion in this essay will focus on the economic implications for HDB flats owners, and in particular on the impact of a depreciating HDB asset on the financial health of the individual.

For brevity, we look at two constructed scenarios to examine the possible implications as the end of the 99-year lease term approaches.

In the first scenario, a young couple in their early 30s sell their Build-to-Order (BTO) flat after their Minimum Occupation Period (MOP), allowing them to “cash out” the various housing grants they were eligible for when they first purchased the flat, and delve into the resale market. They then purchase a mature HDB with 60 years remaining on its lease, hoping to benefit from future upside capital gains.

Tangentially, a single person above 35 who purchases his/her first property in the resale HDB market does so for the same reasons, without the benefit of having had previous housing grants and not being eligible for the CPF Housing Grant for singles due to a monthly salary above $5,000.

There is the possibility that by the time both groups of people retire in 30 years’ time and want to monetise their assets, the value of the house with only 30 plus years lease remaining would have declined significantly due to depreciation effects. This could affect them greatly if the property represents a substantial portion of their wealth, with the single person likely to be more affected, as he or she did not benefit from prior housing grants.

In the second scenario, an elderly retired couple in their 60s purchase a similar resale flat with 60 years remaining on its lease. Their intention is to spend the rest of their golden years in the flat before passing it on to their children, not considering the effects of lease decay. There is thus also the possibility of dampening intergenerational wealth transfers.

There are other scenarios that can be fleshed out. But the examples above put across a plain fact: people who do not take into account the negative wealth effects from HDB depreciation could find themselves in more adverse financial situations in future.

HDB flat buyers will have to consider the issue of lease decay when buying a HDB flat. They should realise the effects of depreciation of their HDB asset on their potential retirement fund. Policymakers on their part should educate the public on the implications of leasehold property depreciation, and provide timely, accurate and salient information about property prices to enhance the efficiency of the resale property market, like what is happening now with revisions to the resale price index. In addition, it may be necessary put in place certain social measures to help individuals who may unfortunately get caught on the wrong foot by the effects of HDB depreciation.

IPS - Published on 9 Feb, 2015

IPS - Published on 9 Feb, 2015

Chang Zhi Yang is a Research Assistant in the Economics and Business cluster and Andrew Yeo is a Research Assistant (Special Projects) at IPS.

Photos by Alan Yeo

No comments:

Post a Comment